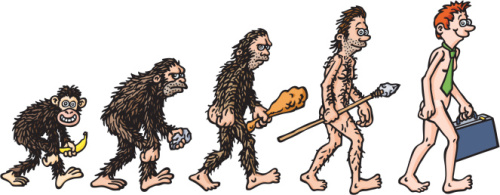

We must transcend our evolutionary history. We’re Ice Age hunters with a shave and a suit. We are not good long-term thinkers.

“If we fail in this great experiment, this experiment of apes becoming intelligent enough to take charge of their own destiny, nature will shrug and say it was fun for a while to let the apes run the laboratory, but in the end it was a bad idea.” ~ Ronald Wright, A Short History of Progress

Clive Hamilton in his Requiem for a Species: Why We Resist the Truth About Climate Change describes a dark relief that comes from accepting that “catastrophic climate change is virtually certain.” This obliteration of “false hopes,” he says, requires an intellectual knowledge and an emotional knowledge. The first is attainable. The second, because it means that those we love, including our children, are almost certainly doomed to insecurity, misery and suffering within a few decades, is much harder to acquire. To emotionally accept impending disaster, to attain the gut-level understanding that the power elite will not respond rationally to the devastation of the ecosystem, is as difficult to accept as our own mortality. The most daunting existential struggle of our time is to ingest this awful truth—intellectually and emotionally—and continue to resist the forces that are destroying us.

The human species, led by white Europeans and Euro-Americans, has been on a 500-year-long planetwide rampage of conquering, plundering, looting, exploiting and polluting the Earth—as well as killing the indigenous communities that stood in the way. But the game is up. The technical and scientific forces that created a life of unparalleled luxury—as well as unrivaled military and economic power—for the industrial elites are the forces that now doom us. The mania for ceaseless economic expansion and exploitation has become a curse, a death sentence. But even as our economic and environmental systems unravel, after the hottest year [2012] in the contiguous 48 states since record keeping began 107 years ago, we lack the emotional and intellectual creativity to shut down the engine of global capitalism. We have bound ourselves to a doomsday machine that grinds forward.

Complex civilizations have a bad habit of destroying themselves. Anthropologists including Joseph Tainter in The Collapse of Complex Societies, Charles L. Redman in Human Impact on Ancient Environments, and Ronald Wright in A Short History of Progress have laid out the familiar patterns that lead to systems breakdown. The difference this time is that when we go down the whole planet may go with us. There will, with this collapse, be no new lands left to exploit, no new civilizations to conquer, no new peoples to subjugate. The long struggle between the human species and the Earth will conclude with the remnants of the human species learning a painful lesson about unrestrained greed and self-worship.

“There is a pattern in the past of civilization after civilization wearing out its welcome from nature, overexploiting its environment, overexpanding, overpopulating,” Wright said when I reached him by phone at his home in British Columbia, Canada. “They tend to collapse quite soon after they reach their period of greatest magnificence and prosperity. That pattern holds good for a lot of societies, among them the Romans, the ancient Maya and the Sumerians of what is now southern Iraq. There are many other examples, including smaller-scale societies such as Easter Island. The very things that cause societies to prosper in the short run, especially new ways to exploit the environment such as the invention of irrigation, lead to disaster in the long run because of unforeseen complications. This is what I called in A Short History of Progress the ‘progress trap’. We have set in motion an industrial machine of such complexity and such dependence on expansion that we do not know how to make do with less or move to a steady state in terms of our demands on nature. We have failed to control human numbers. They have tripled in my lifetime. And the problem is made much worse by the widening gap between rich and poor, the upward concentration of wealth, which ensures there can never be enough to go around. The number of people in dire poverty today—about 2 billion—is greater than the world’s entire population in the early 1900s. That’s not progress.”

“If we continue to refuse to deal with things in an orderly and rational way, we will head into some sort of major catastrophe, sooner or later,” he said. “If we are lucky it will be big enough to wake us up worldwide but not big enough to wipe us out. That is the best we can hope for. We must transcend our evolutionary history. We’re Ice Age hunters with a shave and a suit. We are not good long-term thinkers. We would much rather gorge ourselves on dead mammoths by driving a herd over a cliff than figure out how to conserve the herd so it can feed us and our children forever. That is the transition our civilization has to make. And we’re not doing that.”

Wright, who in his dystopian novel A Scientific Romance paints a picture of a future world devastated by human stupidity, cites “entrenched political and economic interests” and a failure of the human imagination as the two biggest impediments to radical change. And all of us who use fossil fuels, who sustain ourselves through the formal economy, he says, are at fault.

Karl Marx and Adam Smith both pointed to the influx of wealth from the Americas as having made possible the Industrial Revolution and the start of modern capitalism. It was the rape of the Americas, Wright points out, that triggered the orgy of European expansion. The Industrial Revolution also equipped the Europeans with technologically advanced weapons systems, making further subjugation, plundering and expansion possible.

“The experience of a relatively easy 500 years of expansion and colonization, the constant taking over of new lands, led to the modern capitalist myth that you can expand forever,” Wright said. “It is an absurd myth. We live on this planet. We can’t leave it and go somewhere else. We have to bring our economies and demands on nature within natural limits, but we have had a 500-year run where Europeans, Euro-Americans and other colonists have overrun the world and taken it over. This 500-year run made it not only seem easy but normal. We believe things will always get bigger and better. We have to understand that this long period of expansion and prosperity was an anomaly. It has rarely happened in history and will never happen again. We have to readjust our entire civilization to live in a finite world. But we are not doing it, because we are carrying far too much baggage, too many mythical versions of deliberately distorted history and a deeply ingrained feeling that what being modern is all about is having more. This is what anthropologists call an ideological pathology, a self-destructive belief that causes societies to crash and burn. These societies go on doing things that are really stupid because they can’t change their way of thinking. And that is where we are.”

And as the collapse becomes palpable, if human history is any guide, we like past societies in distress will retreat into what anthropologists call “crisis cults.” The powerlessness we will feel in the face of ecological and economic chaos will unleash further collective delusions, such as fundamentalist belief in a god or gods who will come back to Earth and save us.

“Societies in collapse often fall prey to the belief that if certain rituals are performed all the bad stuff will go away,” Wright said. “There are many examples of that throughout history. In the past these crisis cults took hold among people who had been colonized, attacked and slaughtered by outsiders, who had lost control of their lives. They see in these rituals the ability to bring back the past world, which they look at as a kind of paradise. They seek to return to the way things were. Crisis cults spread rapidly among Native American societies in the 19th century, when the buffalo and the Indians were being slaughtered by repeating rifles and finally machine guns. People came to believe, as happened in the Ghost Dance, that if they did the right things the modern world that was intolerable—the barbed wire, the railways, the white man, the machine gun—would disappear.”

“We all have the same, basic psychological hard wiring,” Wright said. “It makes us quite bad at long-range planning and leads us to cling to irrational delusions when faced with a serious threat. Look at the extreme right’s belief that if government got out of the way, the lost paradise of the 1950s would return. Look at the way we are letting oil and gas exploration rip when we know that expanding the carbon economy is suicidal for our children and grandchildren. The results can already be felt. When it gets to the point where large parts of the Earth experience crop failure at the same time then we will have mass starvation and a breakdown in order. That is what lies ahead if we do not deal with climate change.”

“If we fail in this great experiment, this experiment of apes becoming intelligent enough to take charge of their own destiny, nature will shrug and say it was fun for a while to let the apes run the laboratory, but in the end it was a bad idea,” Wright said.

Chris Hedges, a columnist for Truthdig, began his career reporting the war in El Salvador. He spent nearly two decades as a foreign correspondent in Central America, the Middle East, Africa and the Balkans. He has reported from more than 50 countries and has worked for The Christian Science Monitor, National Public Radio, The Dallas Morning News and The New York Times, for which he was a foreign correspondent for 15 years. Reprinted with permission from TRUTHDIG, January 14, 2013, http://www.truthdig.com/report/item/the_myth_of_human_progress_20130113/.